Dividends or Growth? What Finnish Industrial Companies Can Learn from Sweden

7.10.2025

In Finland, there has been a lively debate about whether our companies and boards lean too much on dividends and too little on growth. At August, we’ve argued that growth isn’t optional, it has to be the central project for companies, boards, and policymakers if we want to secure long-term competitiveness.

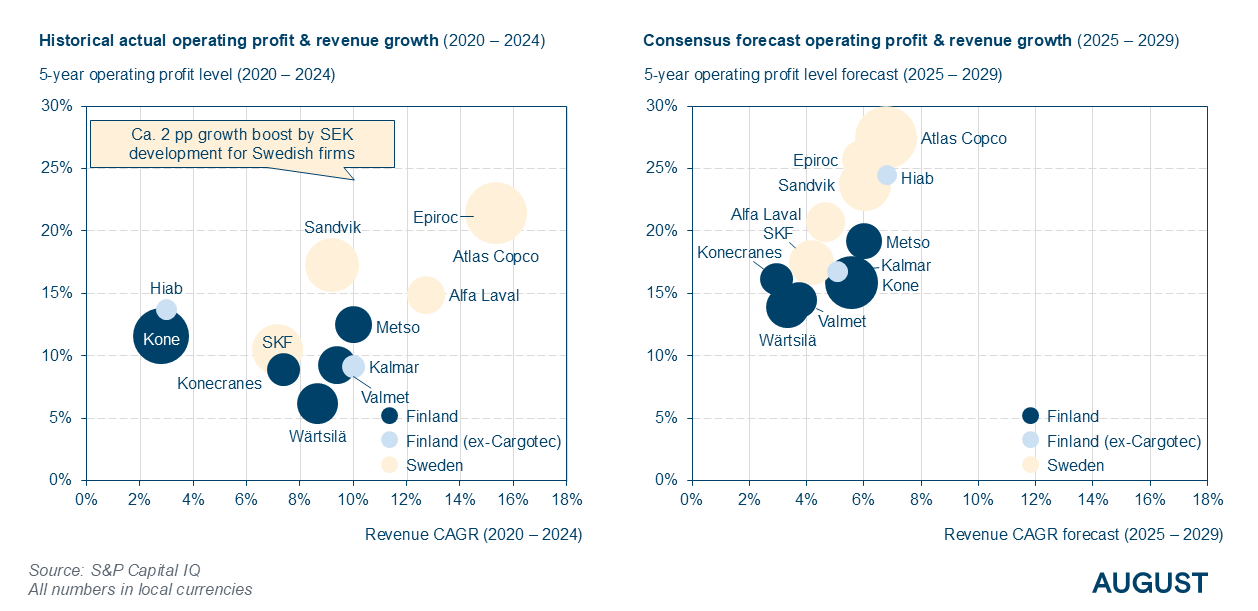

Looking at the numbers in industrial machinery, the picture becomes clear: Swedish peers have been both more profitable and more growth-oriented than their Finnish counterparts, both in history and the markets’ expectation is that also in the future.

Figure 1 Backward and forward looking growth and profitability

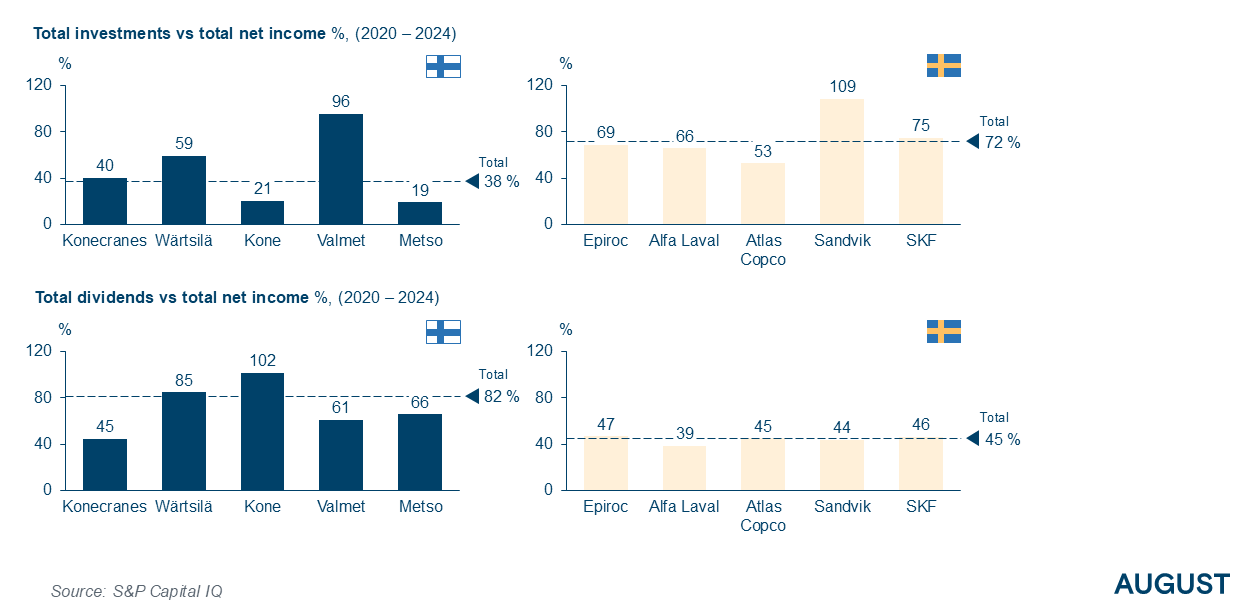

How profits are used: dividends vs. investments

Over the past years, Finnish Industrial Machinery companies have paid out a large share of their net income as dividends. Swedish peers, by contrast, have reinvested bigger portion into growth.

Put simply:

- Finnish companies prioritize dividends, keeping reinvestments modest.

- Swedish companies channel more than half of their net income back into growth initiatives, paying out relatively less in dividends.

Figure 2 Investments and dividends vs. generated net profit

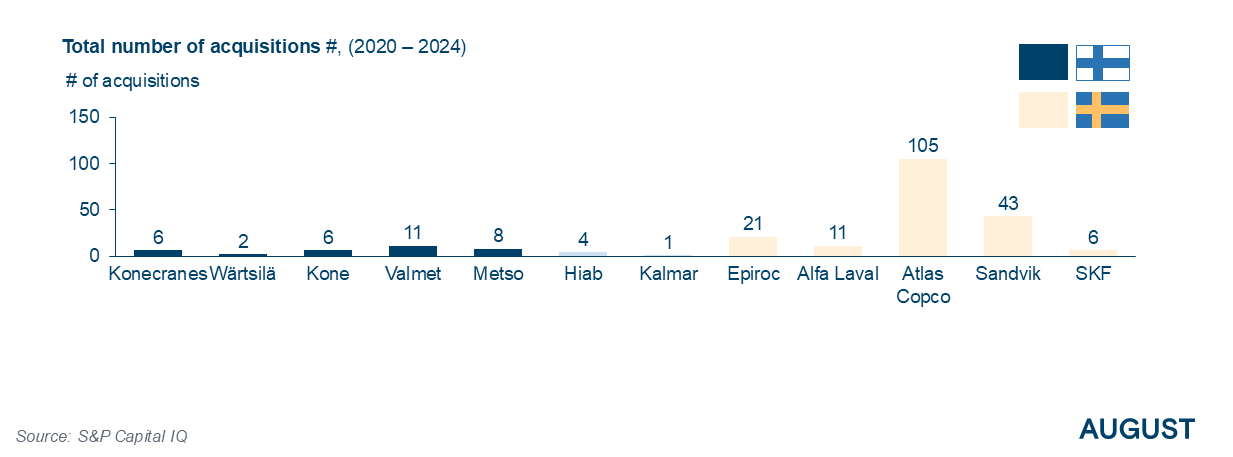

In the Industrial Machinery segment acquisitions are often the practical approach to pursuit growth. Although all details of all acquisitions are not fully disclosed, the story seems again consistent that Swedish companies have been more active in their acquisition / growth agenda.

Figure 3 Acquisitions completed by the companies (2020-2024)

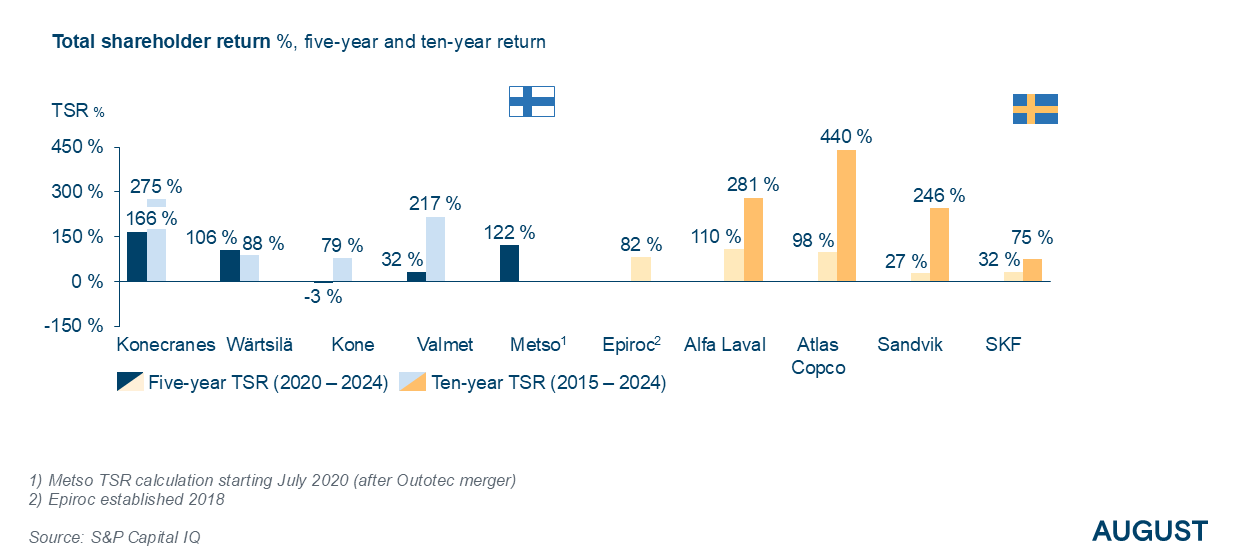

The TSR paradox: good returns, but why?

Interestingly, Finnish names have delivered attractive total shareholder returns (TSR) since 2020. Konecranes, Wärtsilä, and Metso stand out.

But here’s the paradox:

- The strong TSR isn’t explained by higher growth or superior profitability.

- Instead, it reflects a low starting point in 2020, some margin improvement from a weak base, and high dividend payouts.

- In contrast, Swedish peers’ stronger growth and margins have not always translated into superior TSR as the expectation has been already in the share prices.

Figure 4 TSR (local currency) performance of Finnish and Swedish Industrial Machinery companies

What the long term demands

This raises a fundamental question: can Finnish companies rely on dividends and occasional catch-up performance, or must they shift toward sustained growth to remain competitive? Over time, it is growth and profitability that drive shareholder value, and on those metrics, Swedish industrials are still ahead.

The challenge for Finnish boards is not about stopping dividends altogether. It’s about balance:

- Dividends please shareholders in the short term.

- Reinvestments in R&D, capacity, acquisitions and new technologies create the future profits that underpin TSR in the long run.

A call to action

The situation calls for a mindset shift. If Finnish companies want to compete globally, dividends alone won’t secure their future.

Boards and management need to articulate credible growth agendas and back them with investment. That means seeing growth not as optional, but as the central project, just as we at August have emphasized in the wider Finnish discussion.

Markus Valoaho

Markus Valoaho

Partner

+358 40 742 0262

firstname.lastname

Topi Tiitola

Executive Advisor

+358 40 527 8892

firstname.lastname

Related news & insights

Finland needs growth – and companies must deliver it

Nordic Markets 2025 H1: Signs of recovery after a tough start

Commercial Excellence and Profitable Growth

Board’s role in long-term value creation