Learnings from combatting cost inflation

22.11.2021

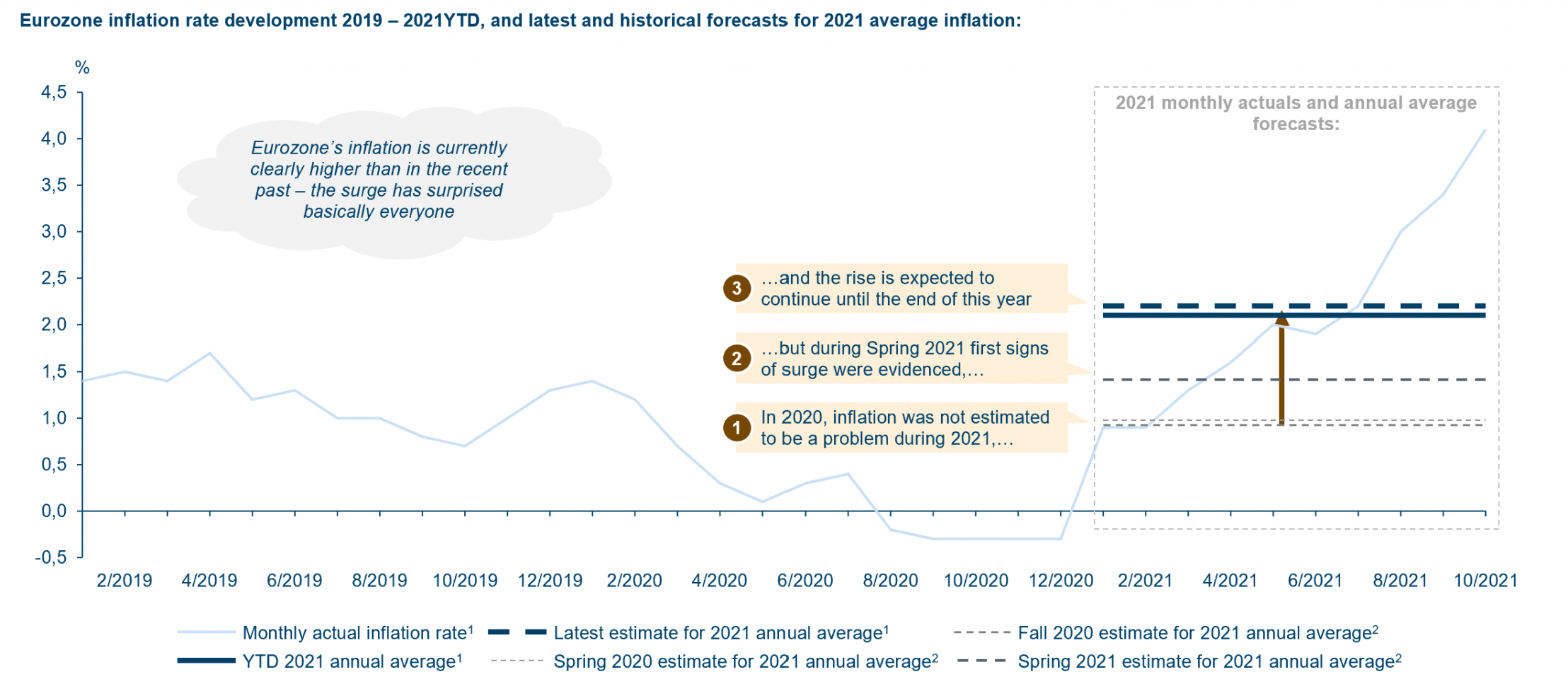

Cost inflation has recently kept management teams busy. For example, in Eurozone the inflation has trended upwards from the beginning of 2021 and is currently clearly higher than in the recent past. High inflation is expected to continue until the end of 2021:

Figure 1: Eurozone’s inflation has been surging during 2021 and the latest forecasts estimate high inflation rates to remain until the end of this year

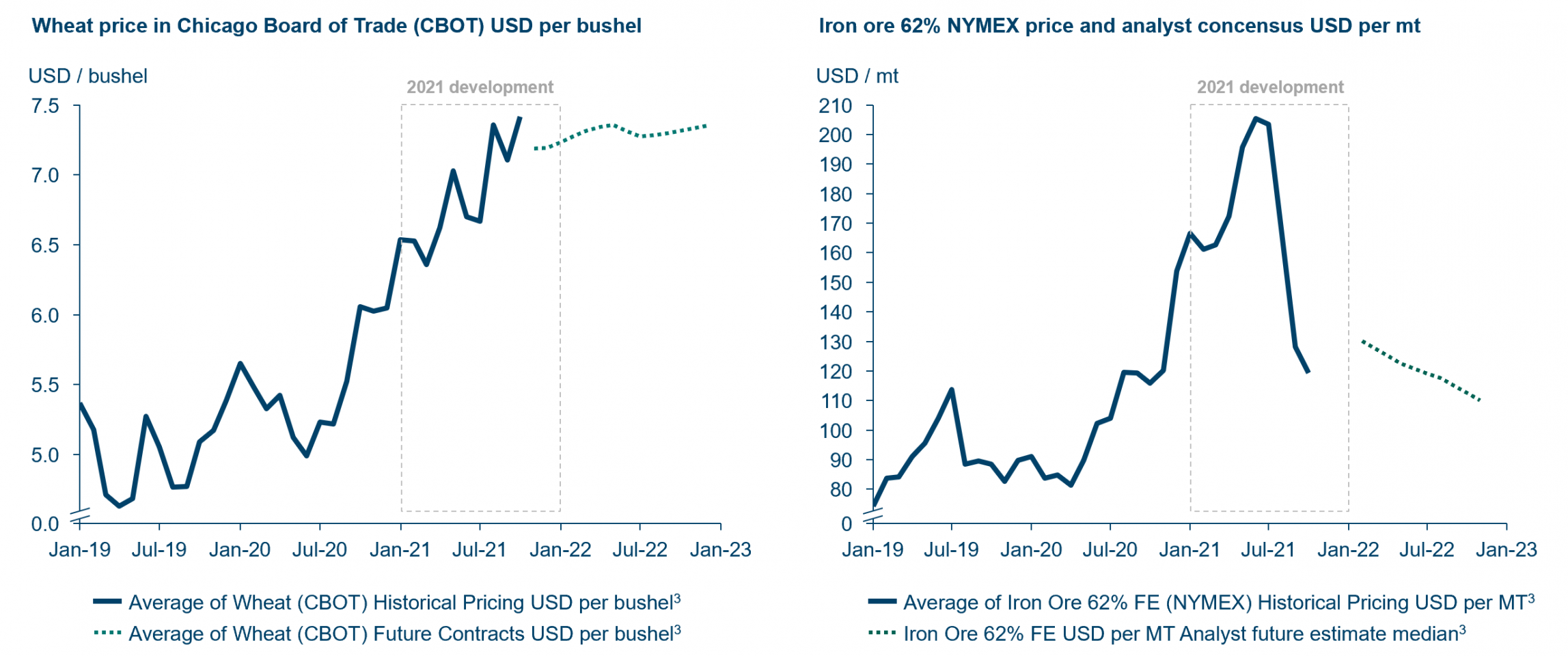

Both energy and numerous commodities have had their share of price surges during this year. As an example, commodities ranging from agricultural products, minerals, steel to chemicals and lumber have reached price levels not seen in many years, or even ever. With many agricultural products (such as oat, coffee, wheat), bad weather conditions have led to shortage of supply, which has been the primary price increase driver. Increased economic activity thanks to, for example, stimulus packages have on the other hand led to rising prices with metals (such as iron ore, nickel, copper) and lumber:

Figure 2: Prices of wheat and iron ore have skyrocketed during 2021

All this has led executives to wonder how to safeguard (or even improve) margins in such a drastic environment and how to be more alert next time when similar cost inflation happens. Based on August’s recent client projects, I have compiled a few key learnings on battling the prevailing cost inflation:

- Despite the immediate margin pressures, the situation also holds opportunity to develop company’s operations and capabilities further. For example, the cost inflation might be the ultimate trigger for a company to start lifting its commercial capabilities to the next level – What could be a better time to start implementing a value-based sales mindset within the organization

- In the short-term, B2B companies, as an example, can take the following commercial measures to safeguard their margins:

- Cutting excessive customer discounts

- Enforcing the charging of value-added services (i.e. concepting ‘service-like’ activities and assigning them a price tag)

- Steering customers’ behavior towards more profitable product and service mix (i.e. product substitutes, cost-to-serve reductions to improve margins)

- Using the understanding on customer perceived value, willingness-to-pay and marginal costs to increase prices

- Shifting to contract models which limit company’s commercial risks (e.g. pass-through cost contract models, price increase clauses, shorter offer validity periods)

- Having more frequent pricing reviews

Additionally, sourcing levers must not be neglected such as renegotiating the contract terms with suppliers, demand re-configuration or value chain collaboration to drive down costs.

- Going forward, companies should prepare to deal with not less but more volatility in their input prices. It is not given that inflation (and high volatility) remains as a short-term guest. Therefore, I believe the following virtues come handy in a world with higher input price volatility:

- Real-time transparency: It is easier to stay on the pulse when you have real-time transparency to what is happening within your own firm, how the underlying profitability drivers are developing, and how the external market is evolving

- Agility in decision making: Rigid corporate planning processes are ill-fit to deal with unpredictable volatility in costs. Agile organizations employing alternative future scenarios, rolling forecasting, and understanding the uncertainty in their plans are much more likely to make better decisions

- Coordination in execution: The more changes in plans, the more coordination is needed. Companies already mature in their Integrated Planning / Sales & Operations Planning practices get an advantage when Sales, Sourcing, Production, Logistics, and other functions work coherently to take actions, which safeguard, or even improve, profitability

To summarize, companies do have means to combat the cost inflation and input price volatility. In the short-term, companies should apply a pragmatic approach to pull commercial and sourcing levers to safeguard their margins. In the long-term, having transparency, agility, and coordination to fight input price volatility is highly critical. It is up to each company how they choose to respond to the challenge.

Please see below links to August’s recent client case examples, which describe how August has together with its clients combatted the cost inflation:

Combatting rising raw material costs with commercial levers

From winning at any cost to maximizing profits