Forecasting the financial results in a Covid-19 world

2.11.2021

“Persons pretending to forecast the future shall be considered disorderly under subdivision 3, section 901 of the criminal code and liable to a fine of $250 and/or six months in prison.”

Section 889, New York Sate Code of Criminal Procedure [1]

As a Danish proverb puts it, it is difficult to make predictions – especially about the future. But despite the challenge, accurate predictions on the future are seen valuable in most companies. Topics like driver-based planning and advanced analytics in forecasting have been in many companies’ development agenda lately.

But is the exercise worth the effort? How well the companies actually forecast the future and especially did in 2020 – the year when Covid-19 shocked the world? To find out, we reviewed how analysts’ consensus 2020 earnings estimates for the top 100 publicly traded Finnish companies panned out. Analyst guidance was used here as a proxy due to data availability, since in most cases the externally published guidance is only ‘higher than last year’ or similar. EBIT was chosen as the measure to be analyzed, as it is also the most commonly communicated of profitability measures.

About the method:

Since most companies do not publish an exact numeric guidance, analysts’ consensus estimate (source: S&P Capital IQ) one week after publishing guidance (verbal / numeric) was taken as a numeric proxy value for EBIT and compared to financial year actuals for the year. It’s to be noted that all studied companies gave their guidance before there was any notion on the eventual magnitude of Covid-19 crisis in Finland or more widely in Europe (latest guidance March 5, 2020).

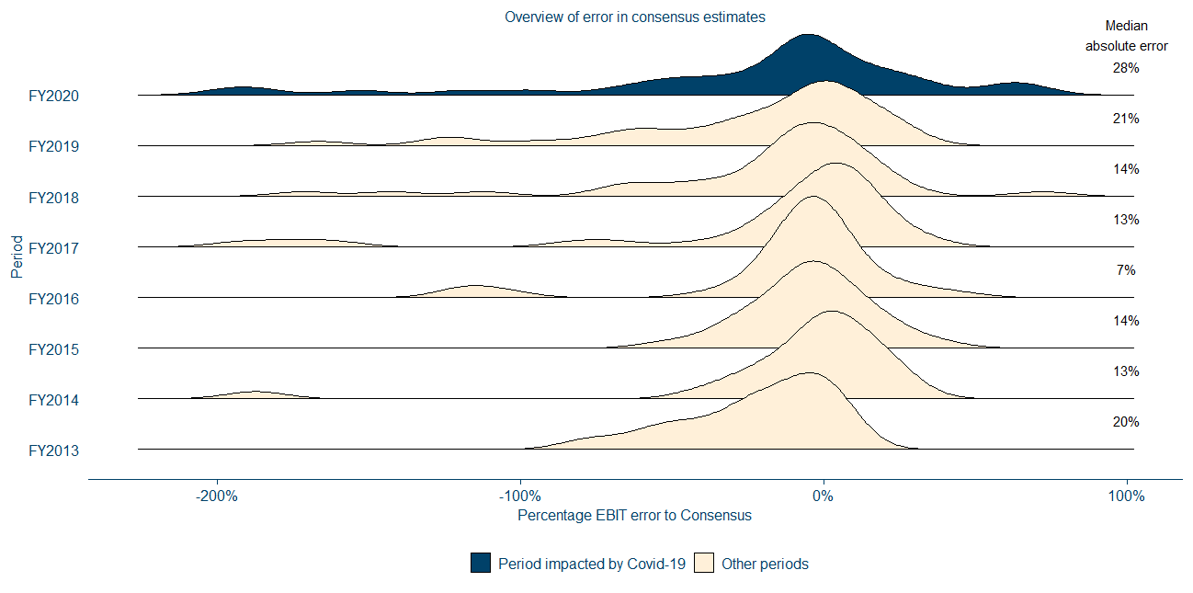

When looking first into percentage errors in the annual EBIT forecasts visually, one notices that it hasn’t been a walk in the park also before. Significant misses have happened also previously and we actually see an increase in the ‘guidance errors’ already in 2019. The error distribution continues to widen in 2020 and reached 29 % (median absolute error). Thus, showing that predicting in 2020, the year of Covid-19, was indeed more challenging on average than previously, but the direction – maybe somewhat surprisingly – was not only downwards.

Figure 1 Error in consensus EBIT forecast per financial year (note: some outliers excluded. Small absolute EBIT value yield easily exceptionally high percentage error.) Source: S&P Capital IQ

The analysis above faces a challenge with companies that have had a small actual or forecasted EBIT when measured in euros. In these cases the percentage error gets easily high. However, eliminating these cases does not in the end change the overall picture.

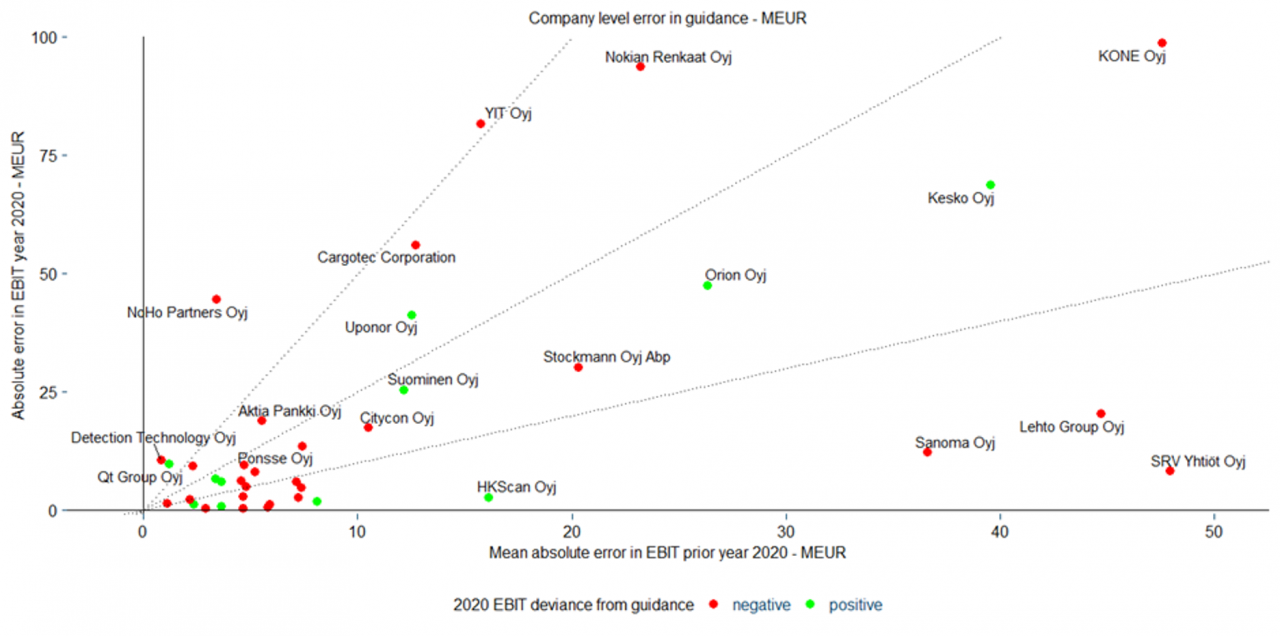

Looking further into actual companies also allows us to eliminate the impact of the small absolute value EBITs. When comparing the success of consensus in 2020 and in previous years on company level, we can see which companies actually had special challenges in 2020 – either due to Covid-19 or for some other reason.

Figure 2 Error in EBIT consensus 2020 vs. previous years (exact number of datapoints depends on the availability, maximum 5 years). Source: S&P Capital IQ

Here we start to see the stories behind the numbers. NoHo Partners, a restaurant company, being obviously severely hit by local restrictions. YIT suffering from delayed real estate investments in commercial real estate. Cargotec and Kone suffering more on the uncertainty in the global economy. Nokian Renkaat suffering from consumer uncertainty and slow driving season. In retail we see Stockmann on losing side and Kesko among the companies that exceeded expectations – obviously Kesko’s more diverse portfolio and larger daily goods business supporting it. Besides retail, ‘winners’ can be seen at least in pharmaceuticals and hygiene products, where both Orion and Suominen mention positive impacts from Covid-19 to their business.

Covid-19 was the ultimate test for forecasting in many companies. Even look at the quarterly numbers gives limited view on the agility / adaptability, as general situation evolved so much during the year. As mentioned, many companies have developed advanced analytics approaches to forecast the future. In practice all those rely in some way to historic information and therefore were useless when the ‘black swan’ appeared.

Is the direction of building analytical models and streamlining processes still valid? I truly believe it is, but management should also always be aware of the limitations and key assumptions the analytical methods have. The uncertainty that is included in these estimates should be well understood. The single point estimates that the models and even traditional processes provide are rarely correct. This requires new kinds of skills into your finance and controlling teams.

What comes to agility, 2020 was probably the year of ultimate surprises for many companies, but as the clock speed in most industries increases, there is work to be done in turning the direction we see already before Covid-19 period.