Don’t overlook cultural fit assessment in your M&A process

28.6.2018

“The merger has been very smooth, as the cultures of the two companies were a perfect fit. That helped us deliver synergies that far exceeded our initial expectations.”

– CEO of NewCO, the merged entity of two former competitors

“We are extremely happy with the acquisition we made. The asset we valued most, the high-performance culture of the acquired company, has been the foundation for exceptional profitable growth.”

– Partner, head of Private Equity investors deal team

You don’t hear this kind of commentary very often. In fact, cultural compatibility happens so seldom, that I had to make up the preceding quotes. A much more common story is that the merger failed to deliver the promised results due to a poor cultural fit.

This shouldn’t be any more surprising than hearing that a marriage didn’t work out even though the bride had a great job and the groom owned a nice house. Yet companies still get blindsided by cultural issues over and over again. As far as I can tell, there are two basic reasons for this common mistake. One is that business people tend to feel more comfortable around quantitative issues; as a rule it’s the soft stuff we find hard. The other is that people simply aren’t aware that there is a proven methodology for assessing cultural fit.

As we have explained in an earlier blog, we know which key cultural factors guide organizational behavior and decision-making, and we know how to identify them. This means that a consultant trained in what organizational researchers call ‘grounded theory – method’, can interview people in the organizations that will be affected by the proposed transaction, assess how well the two cultures will be able to work together, and forecast where there is likely to be friction.

This approach can be applied at any point in the M&A process as long as there is access to do the interviews. Ideally, the interviews should take place early in the due diligence process, when the findings can still influence the decision-making. Needless to say, a merger deal in which buyer and seller have compatible cultures is likely to be much more valuable than a deal where there are many points of potential friction.

The good news is that it doesn’t take that many interviews to get a clear idea of the issues. Discussions with a few individuals at different levels of the organizations are often all it takes to sketch the big picture and identify potential trouble spots. It is the methodology and quality of the interviews that determines the results, not the `n’ of the sample. If it is not possible to get access to interviews during the due diligence phase, this assessment can still be a highly valuable part of post-closing integration, as it will help lay the foundation for successful execution of the strategy.

Conceptually, the technique is simple. Through structured interviews, we examine from the point of view of the individuals what motivates their actions, what helps them in carrying out their work well, and what in turn prevents them from achieving top performance. By comparing, analyzing, and combining these descriptions, we can form a picture of the most essential issues affecting performance on the company level.

For example, in one recent case, we found that two companies planning a merger had very different performance steering practices. While one company emphasized team performance, the other had targets and KPIs linked strongly to individual performance. Designing complementary steering practices for the NewCo clearly needed to be a priority for ensuring future high performance.

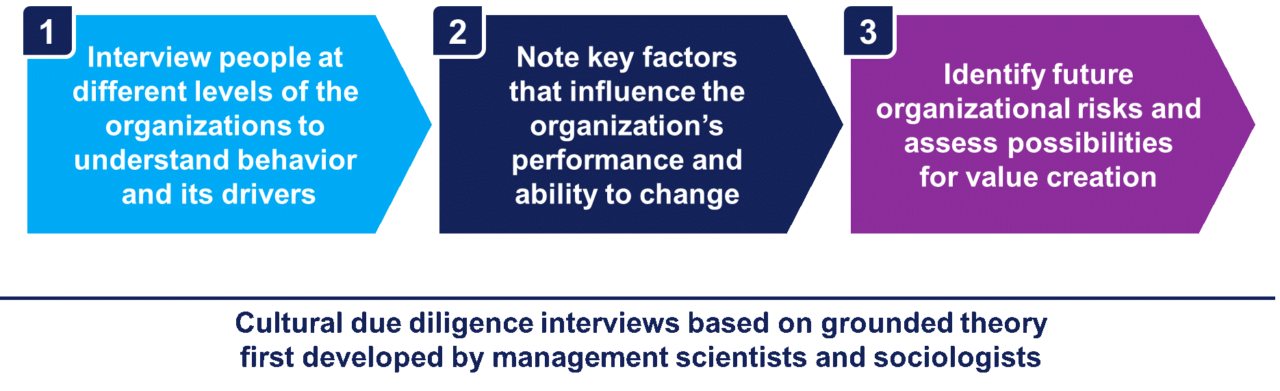

In practice, our approach to cultural due diligence is a three-step process:

Figure 1. August’s approach to cultural due diligence using grounded theory analysis.

Long used by the world’s leading management researchers, grounded theory has been part of August’s toolkit for two years now. So far, our clients have been very happy with the results. The cultural due diligence that is possible thanks to this method can be an extremely useful both for the new owners and management.

To learn more about our services for transactions, organization, and leadership, check out our services.