AI in Finance: Key Insights from Finnish Finance Executives and August Finance Forum 2025

17.12.2025

This Autumn August interviewed Finance executives from Finnish companies to discuss AI and its adoption in Finance functions. The findings from this study were presented in August Finance Forum 2025 event on December 2, 2025. The event also included a keynote speech by Firemind’s Fernando Herrera and a panel discussion by Juuso Pajunen (CFO, Terveystalo), Nenad Veselinovic (Senior Manager, Outokumpu), and Fernando Herrera. This blog post recaps the key learnings from the study and the event.

Background

As we all know, AI has been extensively in the headlines for the past few years – a big factor in the surge of AI use-cases within business context has been the development of large language models (LLMs). Also, agentic AI is entering the stage fast, bringing new possibilities to automate processes and to increase organizational efficiency even further. Against this backdrop, we wanted to understand how CFOs and other Finance executives are approaching AI in their Finance functions: What have been the use-cases for AI thus far? What kind of benefits have there been? How high will further AI adoption be on Finance function’s development agenda?

Outcomes of the study

Current state of AI usage within Finance functions

One thing is clear: on average, Finance functions in Finnish companies are still very much in testing phase with AI adoption. 86% of interviewees said that several use-cases have been identified and piloted, but embedding AI in regular workflows is still in early phases.

On the other hand, over 80% of the interviewees mentioned that AI capability development in Finance has not yet been among the highest priorities. Many AI adoption efforts have been driven by individual persons’ own interest (for example, using Microsoft Copilot to produce comments for the monthly management reports) and there has not been that many large scale, coordinated development initiatives regarding AI implementation.

Maybe due to the lack of programmatic implementation efforts the observed benefits of AI usage have been very minimal and limited so far within the Finance functions. 71% of interviewees say that there has not yet been significant step change in efficiency nor in the quality of outputs.

Target state for AI adoption

Going forward, priority of AI adoption is expected to increase within Finance function’s development agenda. This is emphasized by over half of the Finance executives interviewed. The highest potential for further AI usage is seen within Business Controlling and Financial Planning & Analytics domains; maybe because many of the already piloted use-cases have related to transaction handling processes (for example, invoice management). This does not, though, mean that there would not be any further AI potential in these transactional processes or in Financial Controlling in general (for example, within consolidation activities).

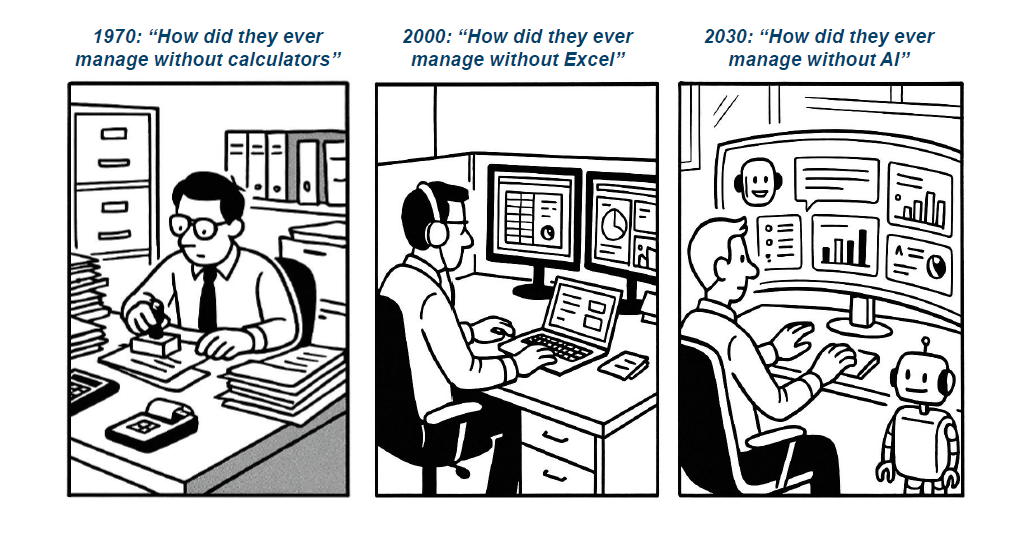

What is more, 79% of the interviewees believe that AI will be a transformative force within Finance functions in the future. The expectation is that adoption of AI will change the traditional ways of working, roles and capability requirements. Based on August’s experiences, the main shift in Finance work will be from ‘executing (more or less) manual traditional finance tasks’ to ‘overseeing and orchestrating automatic AI-driven workflows and processes’. This will free up time for high-value business partnering and even make some traditional finance roles obsolete.

The final interesting result from the interviews is that 64% of the Finance executives prefer to rely on the AI functionalities embedded in the existing Finance applications (i.e. systems used in, for example, invoice handling, consolidation, management reporting, forecasting etc.). Some respondents mention that it would make sense, though, to build custom AI models for really specific use-cases.

What to bear in mind when implementing AI?

The key takeaway from the interviews is that AI adoption in Finance functions is still in early phases, but Finance executives in general see the priority of AI implementation increasing in the future. What to then bear in mind when adopting AI in new use-cases? Based on August’s experiences and the discussions in August Finance Forum, we have highlighted below three critical components to realize the benefits of AI within Finance functions: Data & Processes, Technology, and People.

Data & Processes

No AI model brings the expected value-add, if it does not have the data to do it. ‘Data is the new oil’ is nowadays a lackluster saying, but it definitely holds true with AI usage. For years, companies have been building centralized data repositories (e.g. data lakes) to bring all relevant pieces of data together for reporting and analytics purposes. Maintaining and developing this infrastructure further continues to be important also in the age of AI. Also, process excellence and capability to renew the processes for AI adoption are essential for successful ramp-up of AI use-cases. Lack of data infrastructure and process excellence can be the number one obstacle for adopting AI: thus, focus on data governance, quality and processes remains to be high on companies’ agendas.

Technology

Another key component in AI adoption is technology. Today, many software used in different financial processes already have built-in AI features. For example, some management reporting tools have predictive analytics functionalities and contain free text fields allowing users to ‘ask AI’ to derive insights regarding the monthly figures, as an example. As Firemind’s Fernando Herrera pointed out in his keynote speech during the August Finance Forum, companies already having these software should evaluate whether it makes sense cost-wise to take these functionalities into use (they typically require license upgrade), or whether building custom AI models would be more appropriate for their specific situation. The bottom-line, as the panelists in the event concluded, is that ‘the technology (for AI adoption) is already there’.

People

Finally, maybe the most important thing in AI adoption is the people. The panelists emphasized the importance of leadership during AI implementation. Also, acknowledging that Finance function’s roles and responsibilities as well as capability requirements will need to be rethought is crucial. Using AI needs to bring efficiency gains. This will mean organizational changes. It will mean emergence of new types of roles (e.g., ‘AI super-user’) and new capabilities (e.g., ‘prompt engineering’). In practice, AI adoption will be more groundbreaking from people perspective than from any other angle.

How should Finance functions go forward?

The time for adopting AI in Finance functions is now. Implemented properly, using AI will lead to improvements both in efficiency and quality of outputs. Companies should decide on the most suitable technology (options already exist), ensure people are onboard and equipped for the change (leadership commitment and capability uplifting), and that the implementation efforts are scalable across the organization (instead of just individual persons’ single efforts). Having these prerequisites in place, companies have a better chance of success. AI can make a positive difference, if you only harness it properly.

For more information, please contact:

Juha Martikainen Partner +358 40 756 4686 firstname.lastname@august.fi LinkedIn

Markus Valoaho Partner +358 40 742 0262 firstname.lastname@august.fi LinkedIn